Launch products in weeks with No-Code agility | All Modules in One | AI-Driven Insurance Efficiency.

ProBI: Core Broking Platform

ProBI is a no-code, API-ready, Gen-AI powered platform purpose-built for brokers and authorised representatives. It streamlines the entire broking workflow: from quoting and client servicing to compliance and distribution: bringing everything into one connected ecosystem, fully integrated with all EnsurTek modules.

Policy Admin

ProBI gives brokers a modern broking core to streamline operations and stay compliant.

-

Multi-Carrier Quoting: Compare options from multiple insurers, MGAs, and agencies in one place.

-

Client Engagement: Present choices clearly and bind policies with ease.

-

Broker & AR Management: Oversee authorised reps and broker activities seamlessly.

-

Compliance Oversight: Stay audit-ready with embedded safeguards.

CRM

ProBI provides a complete 360° view of every client relationship.

-

Comprehensive Profiles: Access policies, claims, and payments in one record.

-

Instant Summaries: Review coverage and active claims at a glance.

-

Communication Hub: Keep all client interactions in one clear record.

-

Growth & Compliance: Track CPD and client activity with ease.

Document Manager

ProBI makes documentation fast, consistent, and compliant.

-

Instant Outputs: Generate branded, client-ready documents instantly.

-

Centralised Access: Manage all documents securely in one hub.

-

Consistent & Compliant: Ensure outputs meet brand and regulatory standards.

-

Full Transparency: Track changes with audit-ready history.

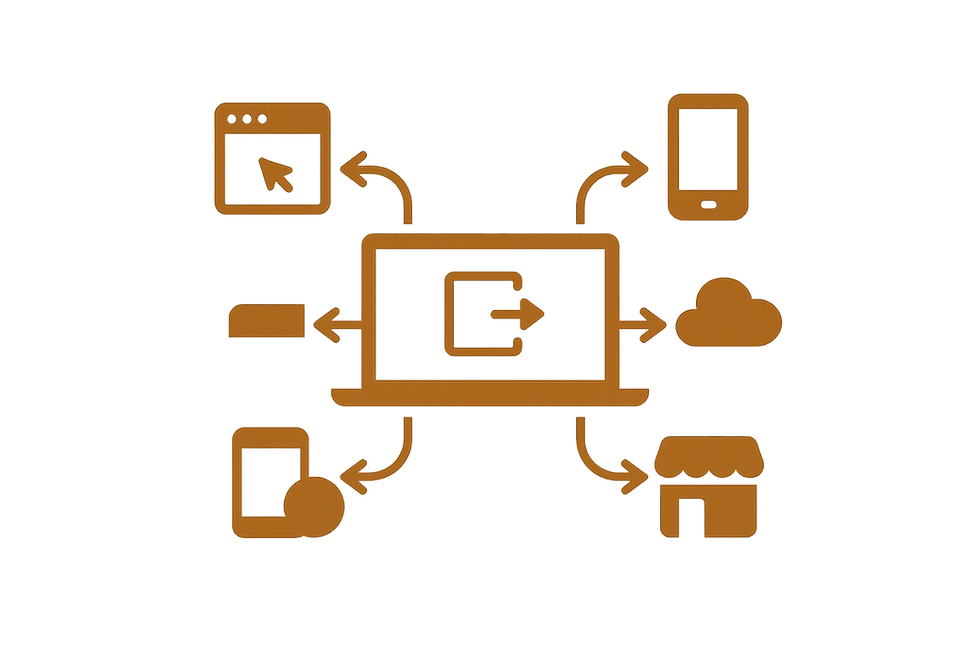

Distribution & Connectivity

ProBI helps brokers reach more clients and markets with modern channels.

-

Broker Portals: Enable quoting, binding, and client self-service.

-

Market Connectivity: Integrate with key industry platforms.

-

Omni-Channel Reach: Expand via D2C, embedded APIs, and mobile.

-

White-Label Solutions: Deliver co-branded portals to partners.

Optional Modules

Pick only what you need or take them all.

Every module connects and works seamlessly together.

FinOps: Finance & Credit Control

End-to-end financial management designed for insurance.

-

Automation: Streamline receipting, reconciliation, payables, debtor management, and cash control.

-

Real-Time Tracking: Monitor commissions, allocations, and payments instantly.

-

Compliance & Accuracy: Maintain audit-ready records and full financial transparency.

-

Seamless Integration: Connect effortlessly with Xero, MYOB, and other accounting systems.

Insights: Reporting & Intelligence

Real-time reporting and analytics, built for insurance.

-

Instant Access: View live policy, claims, and financial data anytime.

-

Automated Reports: Generate compliance, bordereaux, and custom reports in seconds.

-

Interactive Dashboards: Create tailored views for teams and users.

-

Embedded Intelligence: Reporting built into workflows, no extra effort required.

KlaimEZ: Claims Module

A streamlined, end-to-end claims solution for brokers and agencies.

-

Complete Lifecycle: Manage FNOL, reserves, recoveries, transactions, and settlements in one flow.

-

Payment Authorisation: Control approvals and disbursements with built-in safeguards.

-

Compliance & Transparency: Maintain full history and audit trails for every claim.

-

Integrated Workflow: Connect seamlessly with policy admin, reporting, and finance for a unified process.

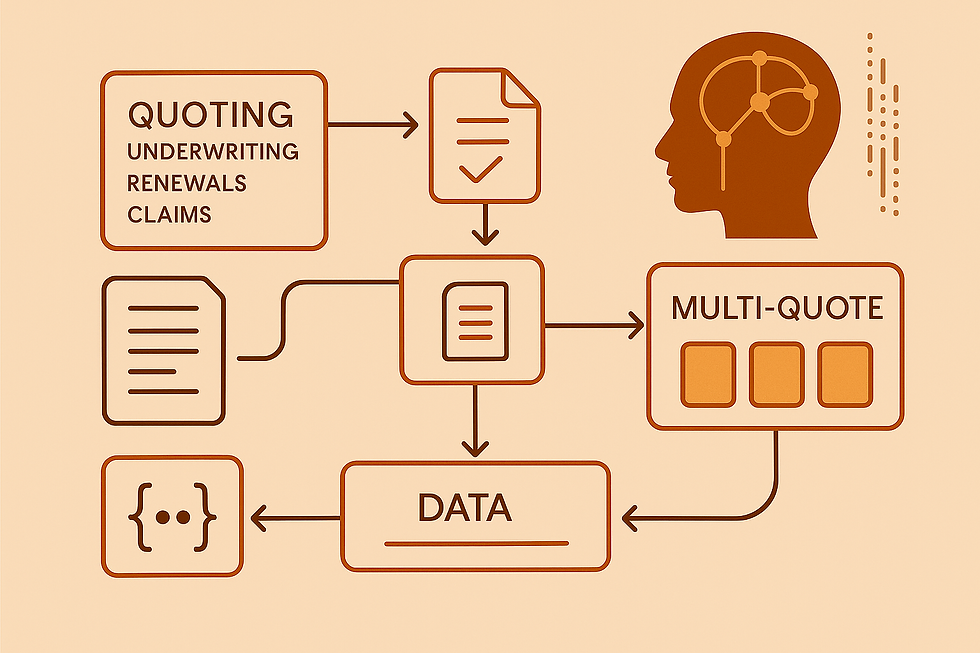

iDA: AI Digital Assistant

A GenAI-powered core that automates and accelerates insurance operations.

-

Smart Automation: Speed up quoting, underwriting, renewals, and claims.

-

Document Intelligence: Instantly read, extract, and summarise complex insurance documents.

-

Data Efficiency: Eliminate repetitive entry with auto-populated forms.

-

Multi-Quote Generation: Create multiple quotes from a single risk submission.

Pain points and Solutions

Pain points

Tracking Transaction is Complex

Solutions

ProBI integrates commission tracking and real-time payment reconciliation, eliminating financial blind spots and ensuring accurate revenue capture.

Pain points

Limited Client Visibility

Solutions

ProBI offers a 360-degree client dashboard that consolidates policies, claims, and interactions, enabling personalised service and better retention.

Pain points

Multiple Quotes Take Too Long

Solutions

ProBI automates data entry and pulls multiple quotes instantly, allowing side-by-side premium and coverage comparisons in one place.

Pain points

Manual Reduce Efficiency

Solutions

ProBI digitises the entire sales cycle—quote to bind to renewal—within a single workflow, reducing manual effort and speeding up transactions.

Pain points

Compliance Burden

Solutions

ProBI automates compliance tasks, generating accurate reports and audit trails with minimal effort, reducing regulatory risk.

Pain points

Limited Connectivity with Tools

Solutions

ProBI’s open APIs seamlessly connect with CRMs, accounting systems, and marketing tools, ensuring brokers work within one ecosystem.

We needed an underwriting platform for our niche insurance product launch. While others proposed lengthy development timelines, EnsurTek delivered a testable version in just one week. Their speed and expertise are exceptional!

Trent Brown

Director Distribution

We launched a new travel product and needed a direct-to-consumer channel. EnsurTek integrated with Battleface for rating and delivered a production-ready solution in under six weeks. Their efficiency and delivery exceeded expectations!

Chris Rouse

CEO

The team have interpreted our requirements beautifully and we are so excited to see one of our classes come to life. Thank you to your team for doing a fantastic job to get started.

Stuart Byars

Director