Launch products in weeks with No-Code agility | All Modules in One | AI-Driven Insurance Efficiency.

Smarter Insurance Platforms for Insurers & Carriers

Faster. Smarter. Stronger.

Launch products faster, streamline operations, and scale distribution with a no-code, API-ready platform designed for insurers.

Built-in Reinsurance & Ceded Management ensures accurate treaty and facultative allocations, recoverable tracking, and seamless ceded reporting.

Policy Admin

A next-generation core built for agility and compliance:

-

End-to-End Control: Handle every stage of the policy lifecycle in one seamless platform.

-

Instant Connections: Plug into brokers, partners, and ecosystems without friction.

-

Reinsurance Ready: Simplify cessions and reporting with confidence.

-

Always Compliant: Stay audit-ready with safeguards built in at every step.

Rating Engine

A powerful, flexible engine to keep your pricing sharp:

-

Accurate Every Time: Underwriting rules and rating methods that drive consistency.

-

Easy to Adapt: Adjust to changing market conditions with no-code agility.

-

Always Up to Date: Stay aligned with current rates across every channel.

-

Seamless Integration: Works hand-in-hand with policy and distribution modules.

Document Manager

Simplify document creation and control:

-

On Demand: Generate all policy documents at the touch of a button.

-

Consistent Branding: Ensure every document reflects your business identity.

-

One Source of Truth: Manage documents centrally in a secure hub.

-

Transparent & Compliant: Every change tracked for peace of mind.

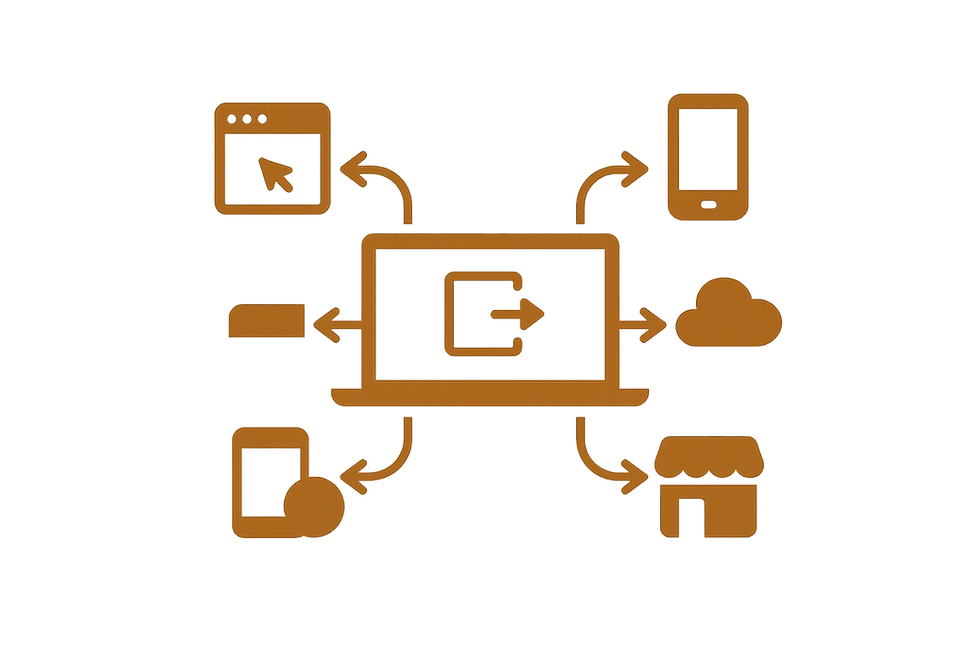

Distribution

Expand your reach and serve customers everywhere:

-

For Brokers: Give intermediaries real-time quoting, binding, and servicing.

-

For Customers: Launch branded, self-service experiences directly.

-

For Partners: Plug products into ecosystems with flexible APIs.

-

For Growth: White-label and co-branded options to scale with ease.

Optional Modules

Pick only what you need or take them all.

Every module connects and works seamlessly together.

FinOps: Finance & Credit Control

End-to-end financial management designed for insurance.

-

Automation: Streamline receipting, reconciliation, payables, debtor management, and cash control.

-

Real-Time Tracking: Monitor commissions, allocations, and payments instantly.

-

Compliance & Accuracy: Maintain audit-ready records and full financial transparency.

-

Seamless Integration: Connect effortlessly with Xero, MYOB, and other accounting systems.

Insights: Reporting & Intelligence

Real-time reporting and analytics, built for insurance.

-

Instant Access: View live policy, claims, and financial data anytime.

-

Automated Reports: Generate compliance, bordereaux, and custom reports in seconds.

-

Interactive Dashboards: Create tailored views for teams and users.

-

Embedded Intelligence: Reporting built into workflows, no extra effort required.

KlaimEZ: Claims Module

A streamlined, end-to-end claims solution for brokers and agencies.

-

Complete Lifecycle: Manage FNOL, reserves, recoveries, transactions, and settlements in one flow.

-

Payment Authorisation: Control approvals and disbursements with built-in safeguards.

-

Compliance & Transparency: Maintain full history and audit trails for every claim.

-

Integrated Workflow: Connect seamlessly with policy admin, reporting, and finance for a unified process.

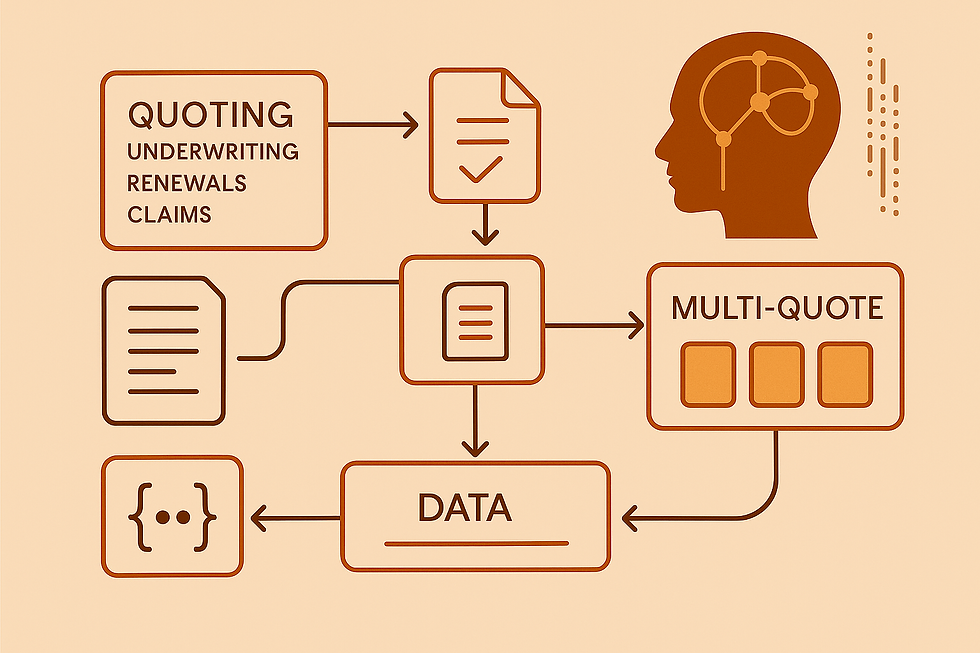

iDA: AI Digital Assistant

A GenAI-powered core that automates and accelerates insurance operations.

-

Smart Automation: Speed up quoting, underwriting, renewals, and claims.

-

Document Intelligence: Instantly read, extract, and summarise complex insurance documents.

-

Data Efficiency: Eliminate repetitive entry with auto-populated forms.

-

Multi-Quote Generation: Create multiple quotes from a single risk submission.

Pain points and Solutions

Pain points

Compliance & Audit Pressures

Solutions

Built-in workflows, automated document generation, and audit trails simplify regulatory compliance and reduce operational risk.

Pain points

Fragmented Policy Lifecycle

Solutions

Manage quotes, binds, endorsements, renewals, cancellations, and claims seamlessly in one end-to-end policy admin system.

Pain points

Rigid Legacy Systems

Solutions

KoverUI replaces slow, inflexible legacy platforms with a no-code, API-driven system that adapts quickly to changing business needs.

Pain points

Complex Product Configuration

Solutions

Solution: Configure risk questions, coverages, pricing, and rules without coding—launching new products in weeks, not months.

Pain points

Distribution Bottlenecks

Solutions

Expand reach instantly with ready-to-use broker portals, consumer platforms, mobile apps, and embedded API integrations.

Pain points

Disconnected Operations

Solutions

Eliminate silos by consolidating CRM, accounting, claims, and reporting into one unified platform—improving visibility and efficiency.

We needed an underwriting platform for our niche insurance product launch. While others proposed lengthy development timelines, EnsurTek delivered a testable version in just one week. Their speed and expertise are exceptional!

Trent Brown

Director Distribution

We launched a new travel product and needed a direct-to-consumer channel. EnsurTek integrated with Battleface for rating and delivered a production-ready solution in under six weeks. Their efficiency and delivery exceeded expectations!

Chris Rouse

CEO

The team have interpreted our requirements beautifully and we are so excited to see one of our classes come to life. Thank you to your team for doing a fantastic job to get started.

Stuart Byars

Director