Launch products in weeks with No-Code agility | All Modules in One | AI-Driven Insurance Efficiency.

Accelerate Innovation, Simplify Operations,

Outpace the Competition

Stay ahead of the curve with fully configurable solutions. Off-the-shelf features, open APIs with seamless updates, and effortless scalability empower you to innovate faster, reduce costs, and outpace the competition. Simplify your tech stack, break down silos, and thrive in today’s dynamic market.

Faster to market. Wider reach. Smarter integration.

1

Speed & Agility

Bring new products to market in weeks, not years. Our no-code, modular platform cuts through complexity so your team can configure, launch, and update with ease. Stay ahead of competitors with the agility to respond instantly to customer and market needs

2

Distribution & Reach

Go beyond traditional broker channels with embedded APIs, direct-to-consumer options, and partner integrations. Our platform makes it simple to expand into new markets while keeping compliance and efficiency at the core. Reach more customers, wherever they are.

3

Integration & Connectivity

Unify policy admin, claims, accounting, and reporting in a single digital ecosystem. No more juggling disconnected systems — everything connects seamlessly, reducing errors and wasted effort. Empower your team with real-time visibility and control across the entire insurance lifecycle.

Core Platforms

ProBI - Broker Platform

ProBI is an all-in-one broking platform designed to grow your book, streamline workflows, and ensure compliance. Instantly compare multiple carrier quotes side-by-side and bind policies directly through integrated portals. Manage clients with a 360-degree view of policies, claims, and communications in one place. Track commissions, reconciliations, and payments in real time while automating regulatory bordereaux, licensing, and compliance reporting. ProBI’s open APIs connect seamlessly with CRM, accounting, and marketing tools, creating a unified broking experience.

KoverUI - Policy Admin System

KoverUI is an end-to-end policy administration system that simplifies product lifecycle management and accelerates digital transformation. Build and modify personal, commercial, or specialty lines with configurable rates, underwriting rules, coverages, and endorsements. Streamline distribution with broker portals, self-service journeys, embedded APIs, and manage commissions, referral fees, and partner hierarchies effortlessly. Automate billing, accounting, collections, and reporting, with built-in BI tools and seamless integration to external systems. KoverUI also generates and manages quotes, policies, and certificates with secure, customisable document workflows.

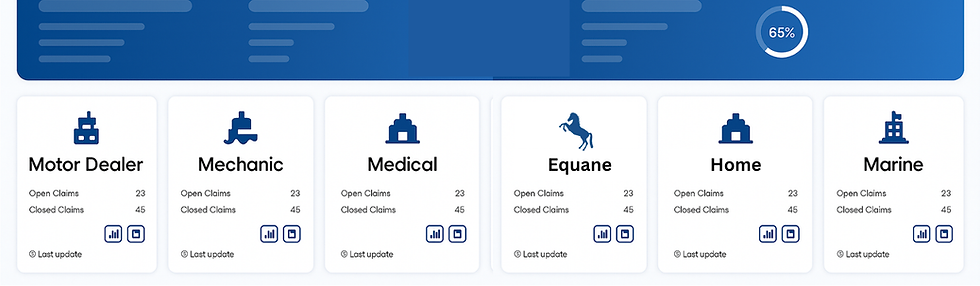

KlaimEZ - Claims Module

KlaimEZ simplifies claims management by delivering a frictionless customer experience while ensuring control and compliance. Capture First Notice of Loss (FNOL) digitally through broker portals, mobile apps, or partner channels with guided intake and data validation. Automate claim workflows by routing based on product, location, severity, and risk, while streamlining communications, reserving, and settlements. Manage assessors, adjusters, and repair partners efficiently with integrated vendor billing. Enable self-service for claimants to upload evidence, track claim status, and receive real-time payment notifications.

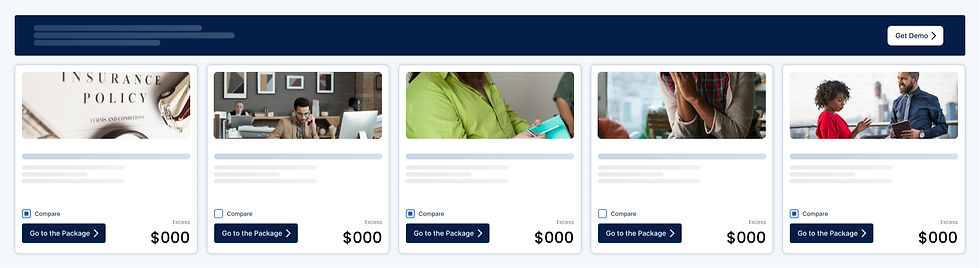

SureFI - Insurance MarketPlace Platform

SureFI is a distribution accelerator that expands your reach beyond traditional channels through seamless integrations. Plug-and-play APIs enable quoting, binding, and policy issuance directly within partner websites, mobile apps, and point-of-sale systems. Curate and manage product offerings for banks, retailers, travel companies, and comparison platforms with ease. Automate partner commissions, premium splits, and earnings reporting while delivering co-branded or fully white-labeled customer journeys. SureFI’s analytics dashboard tracks partner, product, and channel performance, empowering you to optimize conversions and profitability.

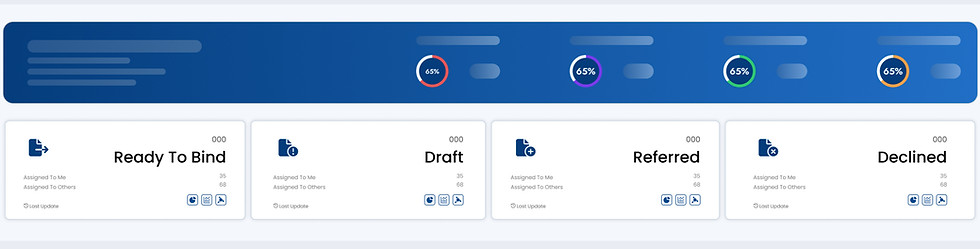

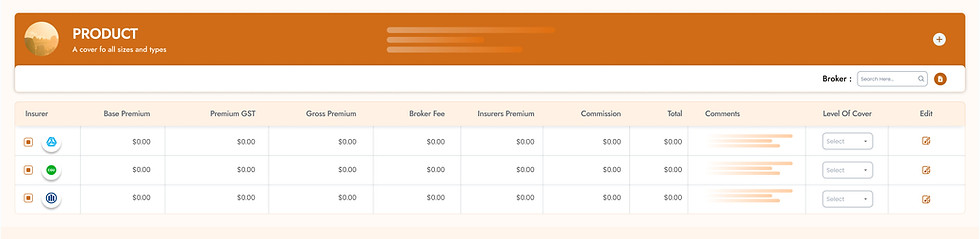

KoverUI - Policy Admin System

KoverUI is an end-to-end policy administration system that simplifies product lifecycle management and accelerates digital transformation. Build and modify personal, commercial, or specialty lines with configurable rates, underwriting rules, coverages, and endorsements. Streamline distribution with broker portals, self-service journeys, embedded APIs, and manage commissions, referral fees, and partner hierarchies effortlessly. Automate billing, accounting, collections, and reporting, with built-in BI tools and seamless integration to external systems. KoverUI also generates and manages quotes, policies, and certificates with secure, customisable document workflows.

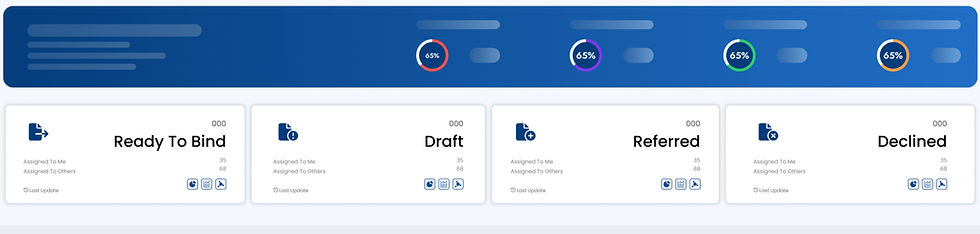

ProBI - Broker Platform

ProBI is an all-in-one broking platform designed to grow your book, streamline workflows, and ensure compliance. Instantly compare multiple carrier quotes side-by-side and bind policies directly through integrated portals. Manage clients with a 360-degree view of policies, claims, and communications in one place. Track commissions, reconciliations, and payments in real time while automating regulatory bordereaux, licensing, and compliance reporting. ProBI’s open APIs connect seamlessly with CRM, accounting, and marketing tools, creating a unified broking experience.

KlaimEZ - Claims Module

KlaimEZ simplifies claims management by delivering a frictionless customer experience while ensuring control and compliance. Capture First Notice of Loss (FNOL) digitally through broker portals, mobile apps, or partner channels with guided intake and data validation. Automate claim workflows by routing based on product, location, severity, and risk, while streamlining communications, reserving, and settlements. Manage assessors, adjusters, and repair partners efficiently with integrated vendor billing. Enable self-service for claimants to upload evidence, track claim status, and receive real-time payment notifications.

Enhance Any Platforms

Add modular capabilities to any EnsurTek solution

iDA - insurance Digital Assist

iDA is a Gen AI-powered solution that automates quoting, underwriting, renewals, and claims by reading, summarizing, and extracting data from complex documents like PDS and proposal forms. As the intelligent core of KoverUI, KlaimEZ, and ProBI, it auto-populates forms, streamlines workflows, and enables users to enter risk data once and generate multiple quotes—fast, accurate, and error-free. Fully no-code and API-ready, iDA simplifies operations and enhances insurance experiences end to end.

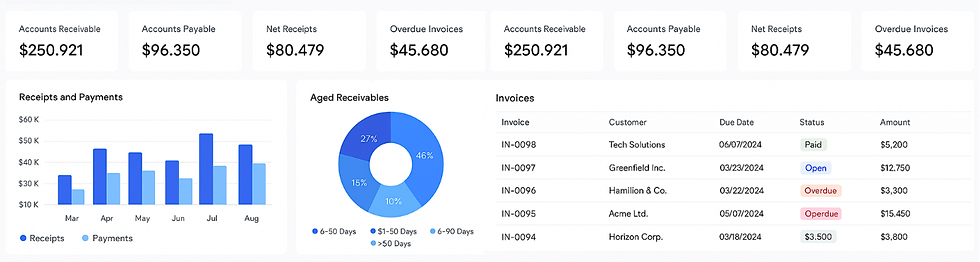

FinOps - Financial Operations

Finance & Trust Management streamlines receipting, reconciliation, and financial controls across your insurance workflows. Automate accounts receivable, payables, debtor management, and trust account reconciliation with built-in settlement workflows. Track commissions, premium allocations, and payments in real time with clear audit trails. Ensure compliance and accuracy while integrating seamlessly with accounting platforms like XERO and MYOB. This module simplifies financial operations, reduces manual effort, and gives you complete visibility over your financial ecosystem.

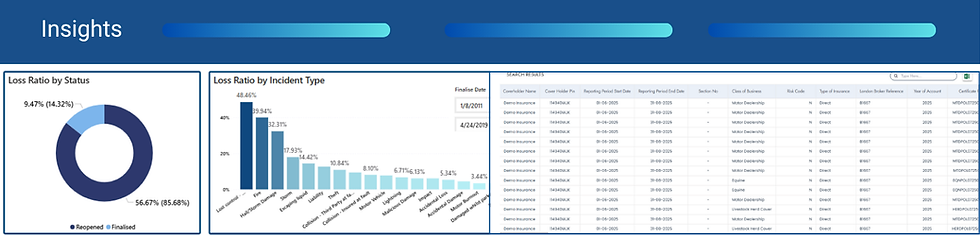

Insights - Reporting & Analytics

Stop wasting time on daily data dumps, manual uploads, and extra staffing just to get the reports you need. EnsurTek’s Insights delivers real-time access to your policy, claims, and financial data—so you always know exactly what’s happening in your business. Generate compliance reports, bordereaux, and custom analytics in seconds. Build dashboards with Power BI directly from live data, tailored to each user’s profile. With Insights, reporting isn’t a separate process—it’s built into your platform.

We needed an underwriting platform for our niche insurance product launch. While others proposed lengthy development timelines, EnsurTek delivered a testable version in just one week. Their speed and expertise are exceptional!

Trent Brown

Director Distribution

We launched a new travel product and needed a direct-to-consumer channel. EnsurTek integrated with Battleface for rating and delivered a production-ready solution in under six weeks. Their efficiency and delivery exceeded expectations!

Chris Rouse

CEO

The team have interpreted our requirements beautifully and we are so excited to see one of our classes come to life. Thank you to your team for doing a fantastic job to get started.

Stuart Byars

Director