Launch products in weeks with No-Code agility | All Modules in One | AI-Driven Insurance Efficiency.

Resources

Insights, industry trends, and product updates from the EnsurTek team.

EnsurTek Announces the Appointment of Chris Rouse as Chief Digital Officer,

October 1, 2024 — EnsurTek, a leader in no-code, API-ready, modular, and AI-powered platforms for the insurance industry, is pleased to announce the appointment of Chris Rouse as Chief Digital Officer. In this pivotal role, Chris will guide EnsurTek’s digital strategy, shaping the company’s future as it continues to drive transformation across the insurance ecosystem.

Furlong Insurance engages EnsurTek for their Underwriting Platform

EnsurTek is delighted to announce that Furlong Insurance has chosen our KoverUI platform for their Equine product. We quickly configured and delivered the product for testing, highlighting our commitment to exceptional service and support!

Trippi has officially launched EnsurTek's KoverUI, leveraging our direct-to-consumer

EnsurTek is pleased to announce that Trippi is using our KoverUI platform for their travel insurance product, successfully going live through our direct-to-consumer portal. We look forward to collaborating with Trippi for their success!

.png)

Allstate Underwriting engages EnsurTek for their Underwriting Platform

EnsurTek is excited to announce that Allstate Underwriting has chosen our KoverUI platform for livestock and herd cover products. We swiftly configured the product for testing, demonstrating our commitment to exceptional service!

.png)

AGD Underwriting Agency selects EnsurTek's KoverUI as their underwriting platform

EnsurTek is excited to announce that AGD Underwriting Agency has chosen our KoverUI platform for their specialized insurance products for motor dealers. We look forward to a successful partnership!

.png)

Mustard Underwriting and EnsurTek join forces for innovative insurance solutions.

EnsurTek announces that Mustard Underwriting has selected our KoverUI platform for underwriting and distribution via APIs and broker portals. We look forward to exceptional service together!

.png)

EnsurTek's Partnership with VIM Cover Highlights Dedication to Tailored Solutions

EnsurTek partners with VIM Cover, a Prism Insurance subsidiary, to offer tailored solutions for hybrid underwriting and brokering across B2C, B2B, and broker portals, ensuring exceptional service!

.png)

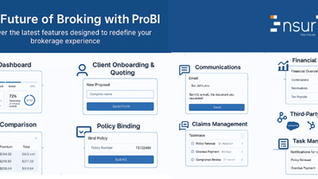

Regional Insurance Professional engages EnsurTek for their Brokering Platform

EnsurTek announces that Regional Insurance Professional has selected our ProBI platform to streamline operations with features like CRM, claims, and automation for multiple quotes—all in one place!

.png)

Mainstay Underwriting Agency Launches Automated Data Extraction with iDA

Mainstay Underwriting Agency has adopted our intelligent digital assistant (iDA) to automate data extraction from Excel to their underwriting system. We're honored to support them and committed to delivering cutting-edge insurance solutions!

.png)

Ausure Go Live with iDA

Ausure has launched automated quoting with our insurance digital assistant (iDA) to enhance efficiency for their representatives. Visit Insurance Business for details!

.png)

IBA engages EnsurTek for iDA

IBA has adopted our insurance digital assistant (iDA) to automate data extraction from Excel to underwriting systems for multiple quotes. We're proud to lead in insurance technology!

.png)

EnsurTek Launches KoverUI & ProBI, the Next-Gen Data-Driven Platform

EnsurTek launched KoverUI and ProBI in June 2023, a no-code, API-ready platform for the global insurance market, allowing quick configuration and distribution of insurance products!

.png)

ITC ASIA

EnsurTek thanks the MGAs, agencies, and brokers who visited our booth at ITC Asia 23. Shoutout to Dilo, Ranjan, and Shehantha for representing us!

.png)

UAC LLOYDS SYDNEY EXPO

EnsurTek thanks the underwriting agencies and brokers at the Sydney UAC Expo, especially Niro, Vishal, Rishon, and Anton, for making the event a success!

.png)

Insurtech Conference, Nashville, TN

Dilo Benjamin presented the no-code KoverUI platform at the WSiA Incutech conference in Nashville, TN, in April 2023. The presentation received positive feedback and generated valuable leads.

.png)

ITC VEGAS

EnsurTek thanks the MGAs, agencies, agents, and brokers who connected with Dilo and Anton at ITC Vegas. We appreciate your support and look forward to delivering innovative solutions!

.png)

NIBA / UAC Expo, Brisbane

EnsurTek thanks the agencies and brokers who connected with Niro and Anton at the Brisbane UAC Expo. We appreciate your support!

.png)

InsurTech Connect Asia, Singapore

EnsurTek’s VP, Jay Pennington-Benton, promoted our no-code platform at a Singapore session, emphasizing its benefits for the insurance industry.

.png)

NIBA / UAC Expo, Melbourne

EnsurTek thanks the agencies and brokers who connected with Anton and Rishon at the Melbourne UAC Expo. We value your support!

.png)

DIGIN, New Orleans, LA

EnsurTek’s VP, Dilo Benjamin, emphasized the importance of data analytics at DIGIN 2022, reinforcing our commitment to innovative solutions.

.png)

UAC Expo, NorWest

EnsurTek enjoyed connecting with industry professionals at the 2020 NorWest UAC Expo, represented by Niro, John, Gregor, and Anton.